NVDA Yahoo Finance A Deep Dive Into Stock Performance and Predictions

Introduction

NVIDIA Corporation (NVDA) has established itself as a leader in the semiconductor and graphics processing unit (GPU) industry. With its groundbreaking advancements in artificial intelligence (AI), gaming technology, and data centers, NVDA stock has seen remarkable growth over the years. Investors are particularly keen on tracking the company’s performance on platforms like Yahoo Finance, which offers a comprehensive view of its stock movements, market sentiment, and predictions. In this article, we’ll dive deep into the stock performance of nvda yahoo finance, explore the factors influencing its stock price, and discuss expert predictions for its future trajectory.

NVDA Overview

NVIDIA, founded in 1993, is a prominent American multinational technology company best known for its GPUs. Over the years, the company has expanded its portfolio, becoming a dominant player in various sectors, including AI, self-driving cars, data centers, and professional visualization. Its GPUs are integral to the gaming industry and are highly sought after by gamers, professionals, and organizations using data-heavy applications. With a market capitalization surpassing $1 trillion in recent years, NVDA has become a key technology company to watch.

NVDA Stock Performance: A Historical Perspective

Over the last five years, NVDA has exhibited significant growth. In 2020, NVDA’s stock price surged, reflecting a broader market recovery as well as optimism around its role in powering AI and data-driven innovation. The company’s acquisition of Mellanox Technologies in 2020 expanded its reach in data centers and cloud computing, providing further impetus for stock performance.

Looking at NVDA’s historical stock chart, we can see a steady upward trajectory, particularly between 2016 and 2022. This was partly driven by the explosion of demand for GPUs in gaming and AI. During the pandemic, NVDA capitalized on the surge in gaming demand, while also expanding its cloud computing and AI applications, making its stock even more attractive to investors.

However, NVDA journey has not been without volatility. The stock witnessed some declines, especially when it faced strong competition from AMD and other tech companies. Yet, NVDA’s ability to innovate and adapt has allowed it to maintain a dominant position in the industry, leading to rebounds in stock value.

Key Factors Influencing NVDA Stock

Several key factors play a significant role in influencing NVDA’s stock price. These factors range from technological advancements and financial health to competition and market sentiment.

Technological Innovation

One of the biggest driving forces behind NVDA’s stock growth is its technological innovation. From its early days as a GPU manufacturer to its current leadership in AI and autonomous vehicle technology, NVDA has been at the forefront of cutting-edge technology. The company’s GPUs are integral to AI research, making it a key player in AI’s explosive growth. Furthermore, NVDA’s push into self-driving technology and its impact on industries like automotive and robotics has garnered investor attention.

Financial Health

NVDA’s strong financial performance is another factor contributing to its stock price. According to recent earnings reports, NVIDIA consistently outperforms market expectations, posting strong revenue growth and impressive profitability. These figures are often the first thing investors look at when evaluating NVDA’s stock on platforms like Yahoo Finance. NVDA’s high margins, solid cash flow, and low debt make it an attractive company for long-term investors.

Market Sentiment

Market sentiment also plays a crucial role in NVDA’s stock performance. Investor emotions and public opinion, reflected through stock movements, often have a significant impact on stock prices. News about NVDA’s product launches, earnings reports, and business partnerships can send shockwaves through the market, driving its stock up or down. Platforms like Yahoo Finance provide detailed sentiment analysis, offering insights into how investors perceive the stock’s future.

Competition

While NVDA has dominated the GPU market, it faces stiff competition, particularly from Advanced Micro Devices (AMD) and Intel. AMD, in particular, has been a strong competitor with its GPUs and processors. This competition can put pressure on NVDA’s market share, and consequently, its stock price. However, NVDA has managed to maintain its lead by continuously innovating and securing significant market opportunities in areas like AI and cloud computing.

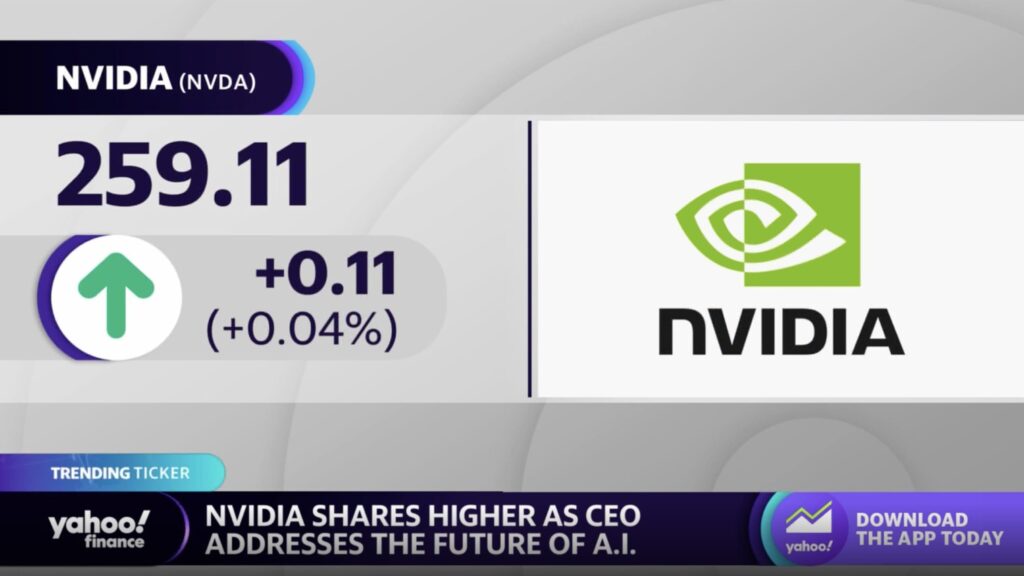

Current Stock Analysis

At present, NVDA stock is priced at a premium compared to its competitors. As of the latest data from Yahoo Finance, the NVDA P/E ratio stands higher than many of its competitors in the semiconductor industry. This is a reflection of the market’s belief in its future growth prospects. Investors view NVDA as a growth stock with significant upside potential, especially given its dominance in the AI and data center sectors.

Technical indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) also suggest that NVDA’s stock has been in a bullish trend for some time. Despite occasional pullbacks, the general sentiment around NVDA remains positive.

The company’s robust earnings reports and continued expansion into profitable sectors have contributed to its strong market position. Analysts have noted that NVDA’s future growth could be driven by its leadership in AI, cloud computing, and autonomous vehicles.

Expert Predictions for NVDA Stock

As of the most recent reports, analysts are largely optimistic about NVDA’s prospects. The stock’s target price varies, but experts generally agree that the stock will continue to perform well in the next several years. Many analysts have given NVDA a “Buy” or “Outperform” rating, with target prices ranging from $500 to $800, depending on the time frame.

In terms of growth potential, NVDA’s stronghold in the AI space is expected to remain a key driver. As industries like healthcare, finance, and transportation adopt AI, NVDA stands to benefit greatly. The rise of data centers and the increasing demand for GPUs in cloud computing are additional tailwinds for NVDA stock. Moreover, the company’s acquisition of Mellanox Technologies has positioned it well for long-term success in high-performance computing, further bolstering its future growth prospects.

Furthermore, NVDA’s involvement in the autonomous vehicle market is another exciting area for growth. With major partnerships with companies like Tesla and a strong focus on AI-driven automotive solutions, NVDA is expected to see significant returns in this sector over the next decade.

Conclusion

NVDA stock has demonstrated a remarkable trajectory, driven by its technological innovations, solid financials, and strong market sentiment. While the company faces competition and market volatility, its ability to innovate and adapt ensures that it remains a leader in the tech space. Platforms like Yahoo Finance provide investors with valuable insights into NVDA’s stock, allowing them to track the company’s performance and make informed decisions.

For long-term investors, NVDA presents a compelling opportunity, especially given its dominance in AI, gaming, and data centers. While its stock price may experience short-term fluctuations, the future looks bright for NVIDIA. As the company continues to expand into new markets and capitalize on emerging technologies, its stock is poised for continued growth.

In summary, NVDA stock offers an exciting mix of past success, present strength, and future potential. Investors should keep an eye on this tech giant, as it’s likely to remain at the forefront of innovation in the years to come.

FAQs

- What makes NVDA a strong investment?

NVDA’s strength comes from its dominance in the GPU market, leadership in AI, and strategic moves into data centers and self-driving technologies. These areas of growth continue to drive investor confidence. - How has NVDA performed on Yahoo Finance?

On Yahoo Finance, NVDA consistently shows strong stock performance, with detailed insights into its financial health, stock trends, and future projections, making it a key stock to follow for market watchers. - What is NVDA’s biggest competitor?

AMD (Advanced Micro Devices) is one of NVDA’s main competitors in the GPU market. Despite this competition, NVDA maintains a lead in several high-growth sectors like AI and cloud computing. - What are analysts predicting for NVDA’s future stock price?

Analysts have set a positive outlook for NVDA, with target prices ranging from $500 to $800, reflecting confidence in its long-term growth due to its leadership in AI and emerging technologies. - Should I invest in NVDA for long-term growth?

NVDA is seen as a solid long-term investment, especially if you’re looking to capitalize on trends in AI, gaming, and autonomous vehicles. However, it’s important to consider market risks and competition when making decisions.